Last month we discussed how to prepare yourself to sell your home but now is the time to talk about preparation for buyers. We’re all aware that the market is not the same as it has been over the last few years. Interest rates have risen, some buyers have left the market, and there’s still some uncertainty about what the future holds. Now I’m no Biff Tannen with some kind of real estate almanac showing what’ll happen over the next 50 years, but I can give you insight into what’s happening now and where we are relative to the last 50 years.

risen, some buyers have left the market, and there’s still some uncertainty about what the future holds. Now I’m no Biff Tannen with some kind of real estate almanac showing what’ll happen over the next 50 years, but I can give you insight into what’s happening now and where we are relative to the last 50 years.

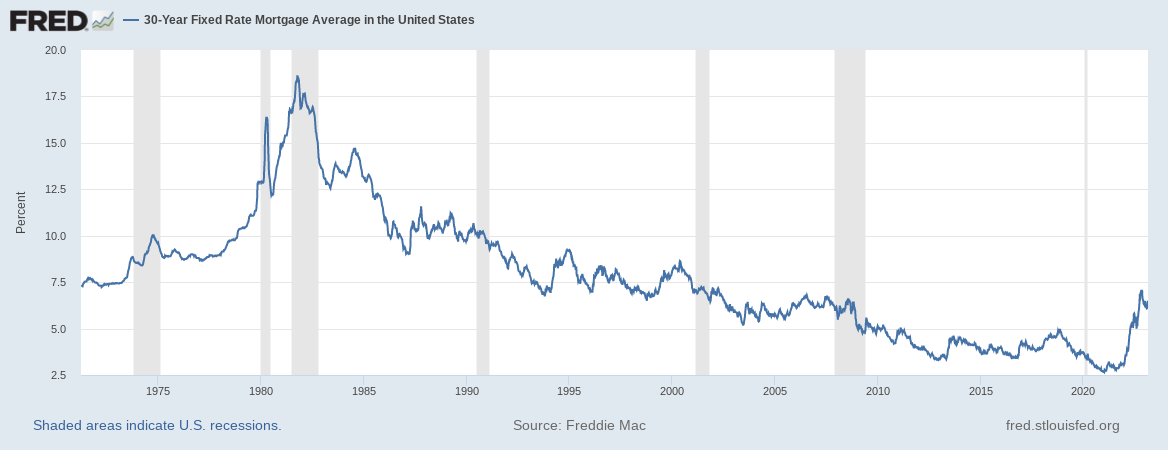

Lets start with the 30 year fixed rate mortgage. There’s been a lot of talk about rising rates and they’d seemed to have settled down into the low to mid 6% range recently but jumped to just over 7% today. That’s nearly twice what they were a year ago. Scary right? To quote Lee Corso, “not so fast my friend”. The good news is that the average over the last 50 years is about 7.75% so we’re still slightly below average. Forbes put out an interesting article about just that at the end 2022. In the 80’s rates eclipsed 18% so historically we’re still in pretty good shape. Buyers today will be in good shape if rates continue to rise and if they fall, there’s always the option to refinance.

settled down into the low to mid 6% range recently but jumped to just over 7% today. That’s nearly twice what they were a year ago. Scary right? To quote Lee Corso, “not so fast my friend”. The good news is that the average over the last 50 years is about 7.75% so we’re still slightly below average. Forbes put out an interesting article about just that at the end 2022. In the 80’s rates eclipsed 18% so historically we’re still in pretty good shape. Buyers today will be in good shape if rates continue to rise and if they fall, there’s always the option to refinance.

Many younger buyers and first time home buyers have been scared off by the increase in rates. If you’ve though of buying this year, that’s good news for you. With a little historical perspective and some clearing of the playing field, you’ve got the advantage. Inventory may still be low (we’ll see if that changes in the spring) but buyers have a little more power than the have lately. You won’t have to fight as hard, go so far over asking that the appraisal is a concern, or put up huge due diligence fees or earnest money deposits. In that way, the initial buying process may actually be less expensive.

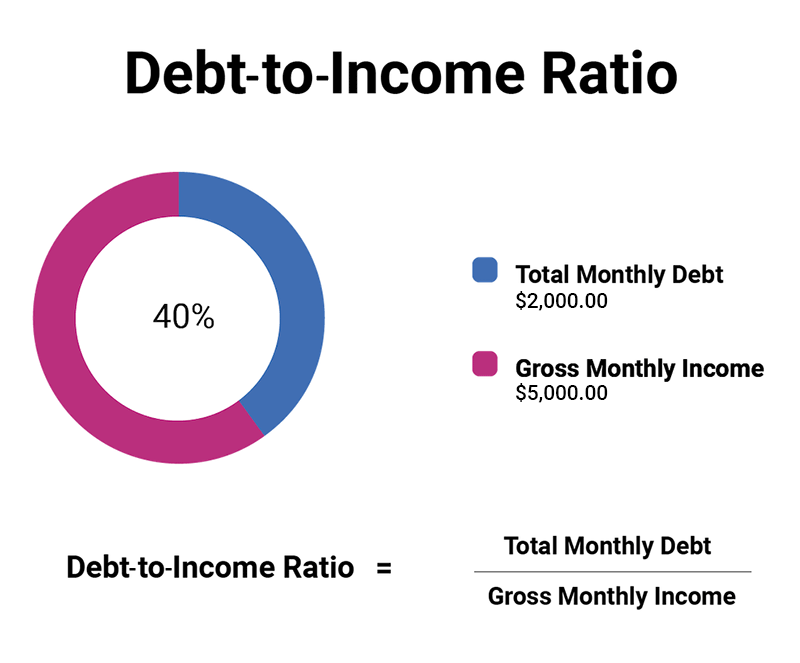

Now for the preparation. First and foremost, speak with a lender. Speak with multiple lenders. They can help you understand all of the different types of loans, tools, and programs that may work best for your needs. They’ll also issue either a pre-approval or full approval for financing. Many realtors won’t even show you a single property if you don’t have that document in hand because many sellers won’t even consider an offer without one of those documents attached. A good lender will also be able to tell you what is coming. One important example of this is that lenders are going to be focusing more on debt to income ratio. We’ve all heard about the importance of a good credit score, and that will still be important moving forward but debt to income ratio is going to be a more prominent factor in your ability to secure financing in the very near future. Ideally, your going to want to have a debt to income ratio of 40%. This means your total monthly debt payments can not be more than 40% of your monthly income.

single property if you don’t have that document in hand because many sellers won’t even consider an offer without one of those documents attached. A good lender will also be able to tell you what is coming. One important example of this is that lenders are going to be focusing more on debt to income ratio. We’ve all heard about the importance of a good credit score, and that will still be important moving forward but debt to income ratio is going to be a more prominent factor in your ability to secure financing in the very near future. Ideally, your going to want to have a debt to income ratio of 40%. This means your total monthly debt payments can not be more than 40% of your monthly income.

The next step is to take the information your lender has given you and organize your finances accordingly. Make  sure that debt to income ratio looks good, know what money you’ll need for closing and where it’s coming from, and don’t make any major moves between approval for financing and closing on your new home. If you were to do something like buy a new car or the boat you can’t wait to take out on Lake Lure, you could jeopardize your ability to get the financing you expected and not only lose the home, but your due diligence fee and earnest money as well. Just secure the best loan product for your situation and then keep your eyes on the prize.

sure that debt to income ratio looks good, know what money you’ll need for closing and where it’s coming from, and don’t make any major moves between approval for financing and closing on your new home. If you were to do something like buy a new car or the boat you can’t wait to take out on Lake Lure, you could jeopardize your ability to get the financing you expected and not only lose the home, but your due diligence fee and earnest money as well. Just secure the best loan product for your situation and then keep your eyes on the prize.

Another thing a lender can help you figure out is, if you own a home now, how that will factor into the equation. What they’ll approve you for will be different depending on if you plan to buy a property without selling your current home or if you plan to sell this one and buy that one. If you’re going to sell your current home and buy a new one elsewhere, you need to get your home ready to list (see part 1). You’ll likely find yourself in a position in which you make an offer contingent upon the sale of your current home.

As a realtor it seems odd to say this but, if you’ve already got all of the above items ironed out then finding the right realtor is the final step. A good agent can guide you all the way through from square 1 but if you have all of these boxes checked and take all of that info to a realtor they will really be able to put maximum effort into helping you make a smooth transition. It’s also important to know what you want. Give your agent a clear set of criteria. There’s nothing more frustrating for an agent than spending lots of time looking for properties only to have a client ask to see a house that fits none of the criteria the buyer presented. Again, if you come with all of your finances in order and a clear picture of what you want I will work tirelessly to find the right fit for you. If you can demonstrate that you’re serious, its game on.

realtor is the final step. A good agent can guide you all the way through from square 1 but if you have all of these boxes checked and take all of that info to a realtor they will really be able to put maximum effort into helping you make a smooth transition. It’s also important to know what you want. Give your agent a clear set of criteria. There’s nothing more frustrating for an agent than spending lots of time looking for properties only to have a client ask to see a house that fits none of the criteria the buyer presented. Again, if you come with all of your finances in order and a clear picture of what you want I will work tirelessly to find the right fit for you. If you can demonstrate that you’re serious, its game on.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link